Blockchain Technology and its Implications on the Financial Platform

In simple terms, blockchain is a technology that helps keep a record of currency transactions in a detailed manner. These transactions are decentralized without a central record keeping. So, that each player has the record of their transactions. Each transaction is stored in blocks and has detailed information on the currency before it reaches to your wallet. These operations are recorded and distributed in a public ledger for everyone to see and access. It is like if you receive a dollar, that block contains all the notes of the usage of that dollar written on it.

Blockchain and Bitcoin

Blockchain technology led to the innovation of Bitcoin – a digital currency that is accepted by many for making payments. This new revolutionary technology can be used for all transactions where the value is involved. Money, property, goods and services are examples where value-based transactions. Unlike our bill which is regulated by the central authority, Bitcoin is unregulated and validated by the users who pay for goods and services.

Blockchain stores information in blocks and it is shared by everyone who is connected to the block. When each user joins the network he/she is connected to the block for executing transactions. Thus, the Bitcoin blockchain will have all the past details of its usage at any of the point that is available for public access. This also eliminates the need for a central system to hold and validate data.

Conventional banking record all the transactions pertaining to the corresponding account and it is held private meaning as it is accessible only to the account holders. Blockchains, in contrast, records all transactions of all users and sends a copy of the transaction to whosoever is connected to the network. The distributed database system is an open electronic ledger and helps reduce complexities that are involved in all business transactions. As it is a transparent system, it will be useful to agencies and government institutions involved in the registration process. In addition, it can even be implied to medical systems and voting systems. It may even help in identifying the ownership of precious artworks and antiques.

Traditional payments systems do not have the flexibility to detail out the history of ownership of particular period. Though not impossible to retrieve information, but if blockchain technology can provide an efficient payment and network system with more secured encrypted transactions, why not we replace. This technology can save you lot of money as the existing payment systems fail to address the cost reduction in the financial industry.

Blockchain in the Financial Industry

As we have seen in our earlier blog on how fintech is disrupting the banking sector, now with the rise of blockchain – a technology that has the potential to further disrupt the financial industry that we use every day for our business transactions. Let us see the impacts it may create in the financial sectors.

Decentralized system that enhances payment mechanism

As for the traditional payment system where contracts are fulfilled when certain criteria are met and validated by the central authority. In blockchain transactions, the contracts are stored in public ledger surpassing the middlemen to complete the agreement between the two parties smartly in no time.

Blockchains technology has the potential to gear up the real-time payment mechanism that can provide cost-effective techniques for many financial intermediaries who still look upon to the central authority for clearing and settlement. Distributed ledger mechanism leads to inordinate delay in settling transactions and customer dissatisfaction which could be used as a driving force to address the new technology solutions which can better solve these problems.

Let us understand how the payment system works in blockchains. For instance, if A wants to send money to B, the transaction is made as a block and sends the information to the earlier participants who were connected with the same money for validating their transactions for approval. Once the deal is approved the money is transferred to B and gets recorded in the ledger sequentially.

There is no central authority for clearing the transactions. This is the most significant advantage in blockchain as the mechanism is decentralized.

Centralized payment systems are prone to risk as the attacker needs to concentrate on the single entry point. In distributed ledger, one needs to access all networks simultaneously that are connected to the particular transaction that is impossible to succeed. As such these records hold undisputable proof of identity and ownership that prevents fraud and counterfeiting. Blockchain works on a trusted platform where the parties that validate the transactions are called miners. As the data are interconnected transaction gets verified automatically.

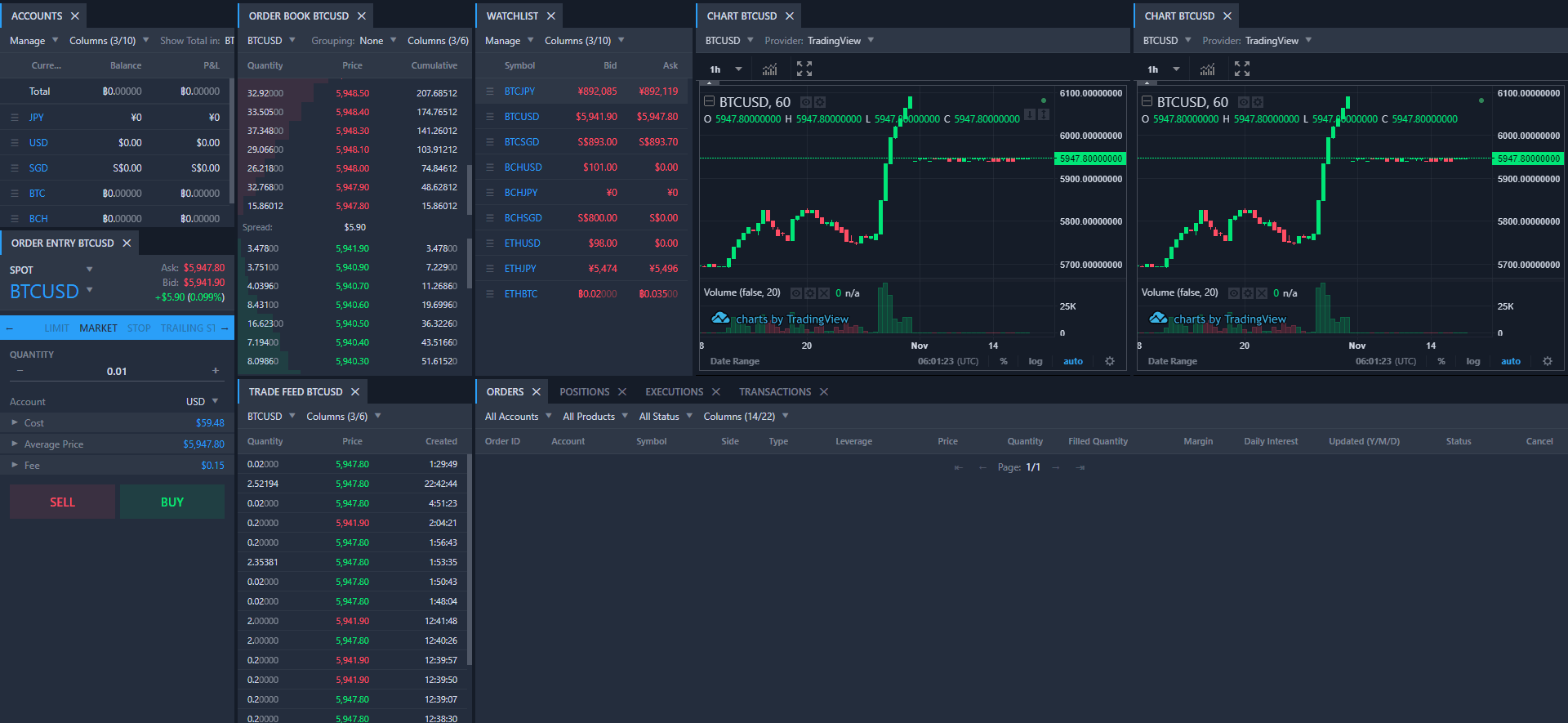

Bitcoin in trading arena

Ref – www.quoinex.com

“As blockchain technology continues to redefine not only how the exchange sector operates, but the global financial economy as a whole, Nasdaq aims to be at the center of this watershed development.” – Bob Greifeld, Chief Executive of NASDAQ.

Blockchain technology has powerful mechanisms to transform the trading platform into an efficient manner. Bookkeeping, a record of ownership and may even boost backend of the trading sectors where hefty costs are involved in maintaining and validating the records of all transactions.

One of the critical aspects of trading is asset management which is at present manually done and slow involving various steps like reconciling, tallying with similar records, etc. are cumbersome. As a result, every transaction goes through such tedious procedures that create complexities and inefficiencies in managing the whole setup. This leads to significant errors in the process.

With blockchain technology, there will be no need to maintain the same records of brokers, dealers, intermediaries, clearing and settlement houses. The distributed ledger provides the parties with a transaction to have access to the same data at the same time. Additionally, there will be a smoother, transparent and most importantly better monitoring of regulation and auditing which will be managed effectively.

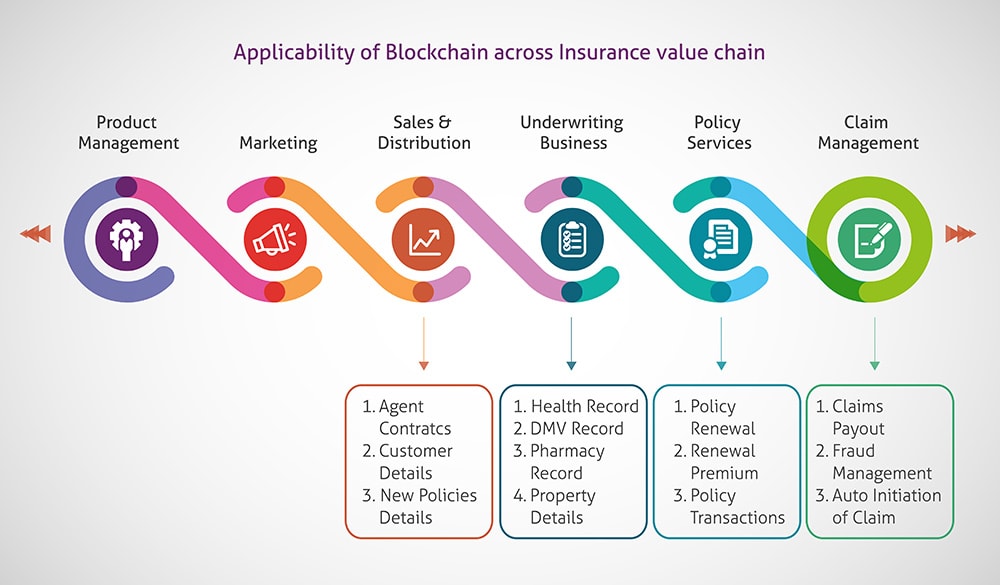

Insurance sectors

Insurance is typically a binding contract between the two parties. The contract involves series of steps like paying premiums, filing a claim, investigation, and final settlement of claims.

Blockchain may change the way insurance businesses deal with their clients. They may well replace legal contracts with a smart contract by embedding the distributed ledger mechanism. Digitally enabled settlements in blockchain create transparency, efficiency and responsive in managing the claims of the customers. Potentially these chained contracts help reduce fake claims.

Insurance contracts are most difficult to understand as it uses a different language to address the legal terms, blockchain can be adaptive and penetrate any line of business, and it is on the move to make radical changes in the traditional way of working.

Another essential contribution blockchain can make into the insurance sector is helping them to settle life insurance files that are unclaimed. The blockchain registry will help connect the dots when the beneficiary is unknown or difficult to trace. Hence the technology while retaining the privacy improves the security concerns and helps the rightful claimant to access the funds when the policy matures.

Blockchains can streamline the subrogate claims where the insurance company fulfills the loss suffered by the insured in the first place and reclaims the loss from the third party (fault-party). These claims are difficult to validate due to the fear of fraud. With a powerful technology such as blockchain, fraudulent claims can be reduced to the minimum, and it will be also easier to know whether the insurer of the faulty party has a ‘waiver of subrogation’.

Waiver means the insurance company may not be able to seek reimbursement; in that case, the company may refuse to compensate the insured. The insured and the insurance company may be benefitted as the blockchain registry holds transparency and a better auditability in all aspects.

Mutual trust between both parties is what makes the insurance company sells its policies in the market. If blockchain can boost trust and faith in the insurance company, it may create a plan in devising the technology in its various lines of business and products. And take the lead in creating more transparency in its operations resulting in increased numbers of people enrolling in the policy.

Blockchains for Financial Institutions Offering Credit

Access to credit facilities is the key driving factor for prosperity. Availing credit to buy a home, business start-ups are critical and more importantly the credit ratings that affect buying a loan. According to the consumer finance report, about 11 percent of the adult population in the United States are credit-invisible and over 8.3 percent of the adult population were treated unscorable. That is approximately 45 million Americans are deprived of a loan from registered financial companies forcing them to access loans from unsecured and dangerous parties working the black market.

This scenario might change with embedding the blockchain platform in the credit industries. The database in blockchain registry might give you a comprehensive credit rating that gives the opportunity to new borrowers to buy loans which may help flourish the financial industry. Credit rating, risk assessment, verification, and identification might come under the blockchain platform to help identify fraud and expand credit facilities across the nation. Blockchain open ledger system may also help also cross-border credit scoring system.

Fintech and Blockchain duo transforming financial industry

Fintech and blockchain add core value to the business. The duo if implemented properly in the business helps assure data integrity, render financial contracts more transparently and automate many laborious records with the technology that can trace the source of the ownership. Take for example how blockchain can implement in a departmental store.

Many times customers return defective products back to the E-commerce site, and it is even found true that sometimes the whole batch of products received at the store are defective. In this situation, if the products are still in the store, it is easy to replace them. But the worse scenario is when these are distributed to local retailers and it is impossible to trace each and every product that is defective. Blockchain with its open ledger system may provide the solution to these problems and help the store to trace the location of every product at ease.

Technologies that help quickly recover from such embarrassments or image loss due to the negligence on the part of the manufacturer. Blockchain can be devised into any line of business that needs traceability across its supply chains. Time saved in such situations is worth a lot of money considering the impact it will have on the market.

Blockchain disrupting in banking sectors

Bankers provide a safe place to keep our money, facilitate payments in our business transactions. They hold the cash effectively to run their business in lending it to institutions and individuals at profit. They effectively provide a market to do business. They provide the platform for global trade and help transfer money to the clients as an alternative to physical cash.

Bitcoin crypto-currency that is already in the market – an alternative to the money we use is increasingly becoming popular. Though accepted only by few businesses, Bitcoin has the potential to replace traditional currencies. However, it is unlikely to dislodge it overnight and it is also difficult to predict how much longer it may take for it to make a strong impact on the economy. But the underlying technology is what the banks are keen to adopt and how they can implement blockchain into their existing system is to be seen.

Cryptocurrency may or may not succeed in the coming times. But if it does than banks should be considering issuing something like a digital currency to combat the threats. Banks cannot ignore the fact that digital age can transform or disrupt any business that has not opened their doors to innovations.

Implementing Blockchain in Fintech industry

Blockchains can be used in different scenarios in the business that deals with value, asset, agreements, record keeping or data storage, contracts and cryptocurrencies.

Blockchain startup Symbiont, a company based in New York is using blockchain technology to develop smart contracts to be used in the trading platform. As discussed earlier how blockchains can transform trading sector (link it to the Blockchain in Trading Arena if possible), Symbiont helps in converting complex financial instruments to understandable language onto a distributed ledger.

From crop to cup, Bext360 uses blockchain technology built by Stellar to assert and assign codes to quality coffee cherries. The machine assorting the cherries assigns tokens to each quality and tracks the product across its lifespan. Coffee supply chains are greatly benefitted by blockchain technology that is built to suit their business.

By 2027, 10 percent of global gross domestic product (GDP) is expected to be stored on blockchain technology. Currently, the total worth of bitcoin in the blockchain is around $20 billion, or about 0.025% of global GDP of around $80 trillion. And since there are only 21 million bitcoins that are going to be produced, their value is only going to keep increasing. Bitcoin had started in 2010 when it was valued at only $0.008, and now in 2017, 1 Bitcoin equals $7,415.86.

As we have seen in the past, with the revolution of the internet, Fintech innovations blossomed and we see the same trendsetter on the rise with the innovation of blockchain technology, all thanks to Satoshi Nakamoto the name often found on the internet credited with the creation of bitcoin.

Some of the wallets that are powered by blockchain technology are given below for your reference. To find out more details about the wallets pursue the link given on each wallet.

Xapo is a company based in Switzerland that provides a bitcoin wallet with a bitcoin-based debit card. It also provides access to the cold storage vault. Ledger is a Cryptocurrency hardware wallet that safeguards crypto assets for individuals and companies. Trezor is a Bitcoin hardware wallet to store and secure your bitcoins. It also provides a variety of alternative digital currencies with a single device.

Leaders who see blockchain technology as an opportunity and not as a threat will lead the business organization to competitive advantage, efficiency in carrying out the business and overcome security threats. Blockchain can well become the potential game changer in the financial industry.